Expo

view channel

view channel

view channel

view channel

view channel

view channel

view channel

RadiographyMRIUltrasoundNuclear MedicineGeneral/Advanced ImagingImaging IT

Events

- Novel Breast Cancer Screening Technology Could Offer Superior Alternative to Mammogram

- Artificial Intelligence Accurately Predicts Breast Cancer Years Before Diagnosis

- AI-Powered Chest X-Ray Detects Pulmonary Nodules Three Years Before Lung Cancer Symptoms

- AI Model Identifies Vertebral Compression Fractures in Chest Radiographs

- Advanced 3D Mammography Detects More Breast Cancers

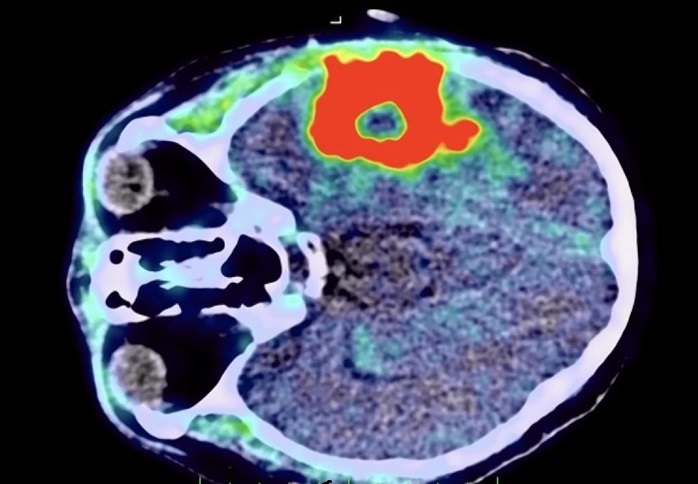

- AI Can Distinguish Brain Tumors from Healthy Tissue

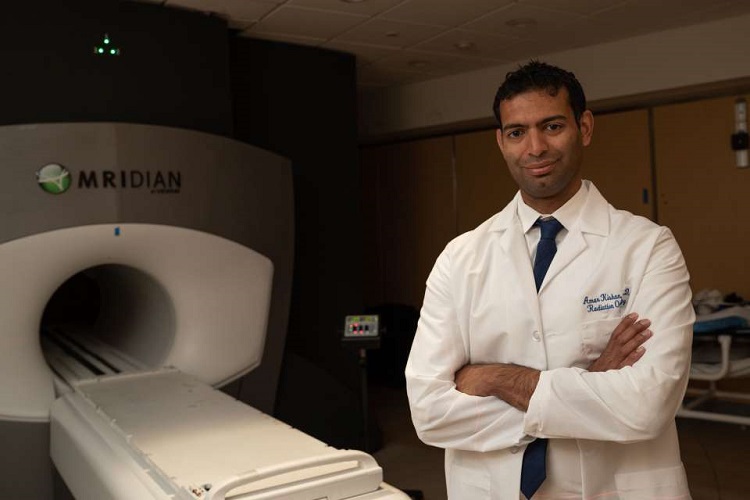

- MRI-Guided Radiation Therapy Reduces Long-Term Side Effects in Prostate Cancer Patients

- Combining Imaging Techniques Could Enable Surgical Removal of Prostate Cancer Without Biopsy

- AI Supported Detection of Cerebral Multiple Sclerosis Lesions Cuts Radiologic Reporting Times

- AI Algorithm Detects 30% Of Breast Cancers Missed on MRI Scans

- New Imaging Agent to Drive Step-Change for Brain Cancer Imaging

- Portable PET Scanner to Detect Earliest Stages of Alzheimer’s Disease

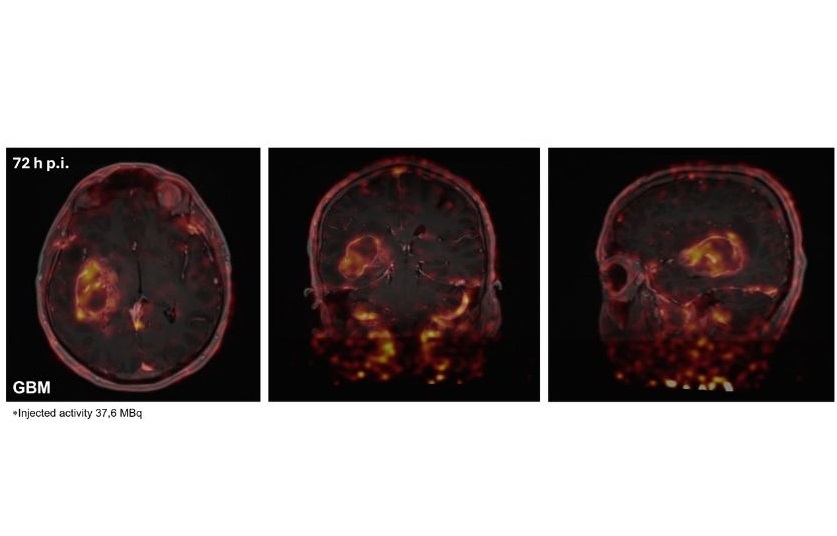

- New Immuno-PET Imaging Technique Identifies Glioblastoma Patients Who Would Benefit from Immunotherapy

- PET Software Enhances Diagnosis and Monitoring of Alzheimer's Disease

- New Photon-Counting CT Technique Diagnoses Osteoarthritis Before Symptoms Develop

- AI Image-Recognition Program Reads Echocardiograms Faster, Cuts Results Wait Time

- Ultrasound Device Non-Invasively Improves Blood Circulation in Lower Limbs

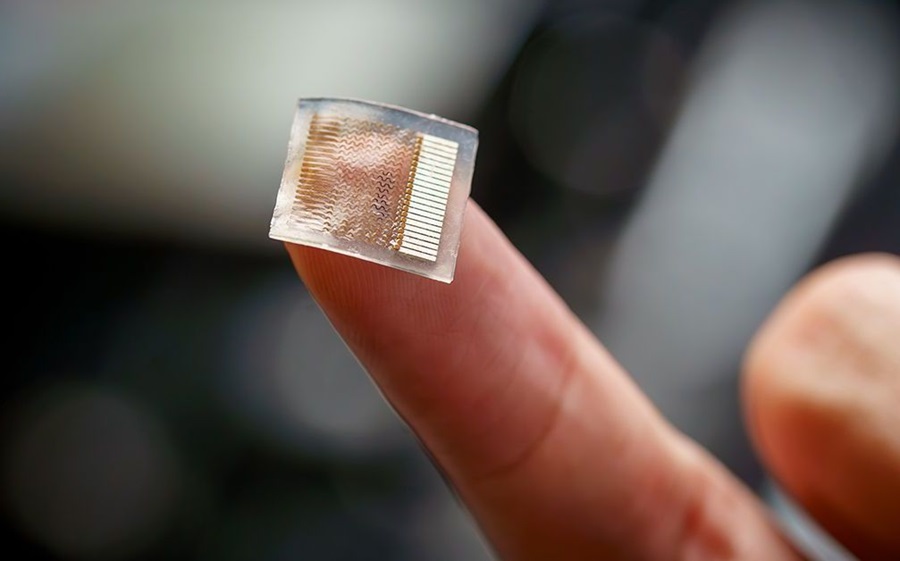

- Wearable Ultrasound Device Provides Long-Term, Wireless Muscle Monitoring

- Ultrasound Can Identify Sources of Brain-Related Issues and Disorders Before Treatment

- New Guideline on Handling Endobronchial Ultrasound Transbronchial Needle Samples

- Automated Multi-Patient CT Injection System Reduces Patient Set-Up Time and Streamlines Workflows

- Low-Dose CT Screening for Lung Cancer Can Benefit Heavy Smokers

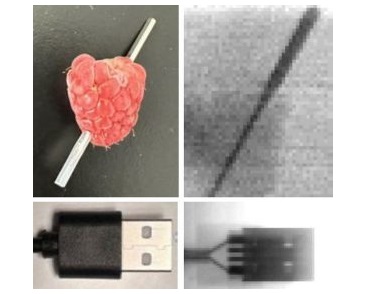

- Non-Invasive Imaging Technique Accurately Detects Aggressive Kidney Cancer

- AI Algorithm Reduces Unnecessary Radiation Exposure in Traumatic Neuroradiological CT Scans

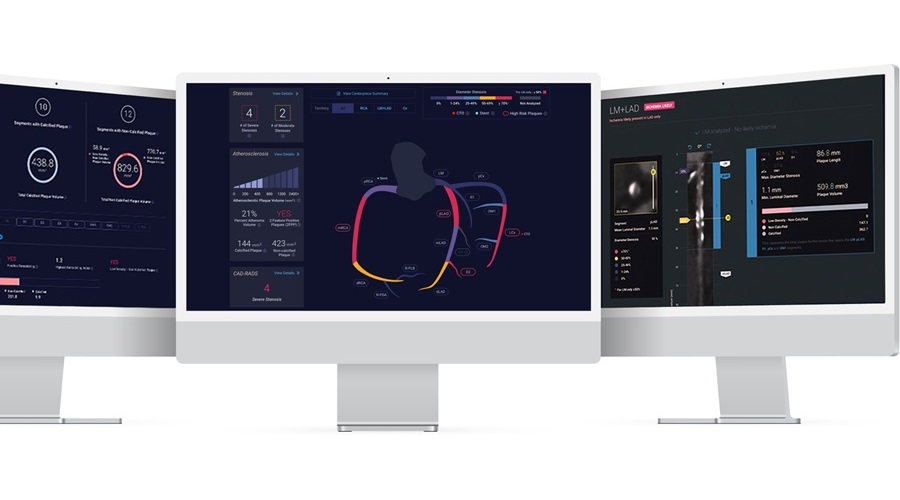

- New Solution Enhances AI-Based Quality Control and Diagnosis in Medical Imaging

- Global AI in Medical Diagnostics Market to Be Driven by Demand for Image Recognition in Radiology

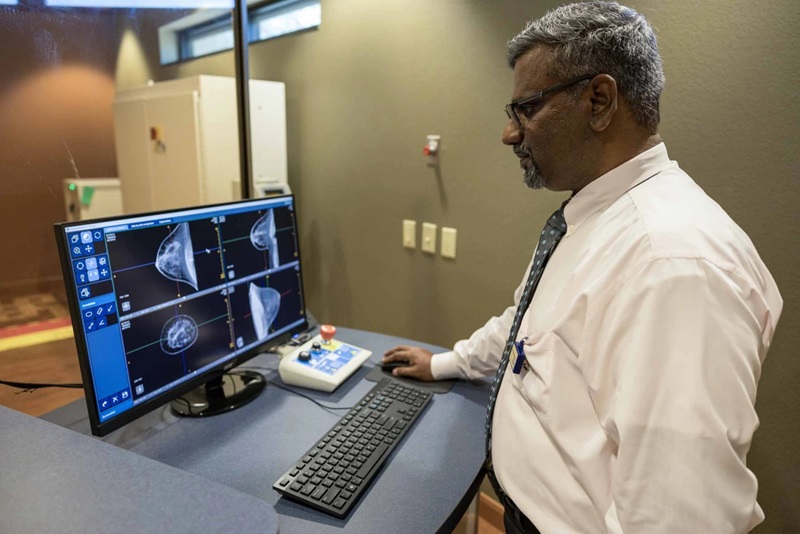

- AI-Based Mammography Triage Software Helps Dramatically Improve Interpretation Process

- Artificial Intelligence (AI) Program Accurately Predicts Lung Cancer Risk from CT Images

- Image Management Platform Streamlines Treatment Plans

- AI Technology for Detecting Breast Cancer Receives CE Mark Approval

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

- Philips and Medtronic Partner on Stroke Care

- Siemens and Medtronic Enter into Global Partnership for Advancing Spine Care Imaging Technologies

- RSNA 2024 Technical Exhibits to Showcase Latest Advances in Radiology

- Bracco Collaborates with Arrayus on Microbubble-Assisted Focused Ultrasound Therapy for Pancreatic Cancer

Expo

view channel

view channel

view channel

view channel

view channel

view channel

view channel

RadiographyMRIUltrasoundNuclear MedicineGeneral/Advanced ImagingImaging IT

Events

Advertise with Us

view channel

view channel

view channel

view channel

view channel

view channel

view channel

RadiographyMRIUltrasoundNuclear MedicineGeneral/Advanced ImagingImaging IT

Events

Advertise with Us

- Novel Breast Cancer Screening Technology Could Offer Superior Alternative to Mammogram

- Artificial Intelligence Accurately Predicts Breast Cancer Years Before Diagnosis

- AI-Powered Chest X-Ray Detects Pulmonary Nodules Three Years Before Lung Cancer Symptoms

- AI Model Identifies Vertebral Compression Fractures in Chest Radiographs

- Advanced 3D Mammography Detects More Breast Cancers

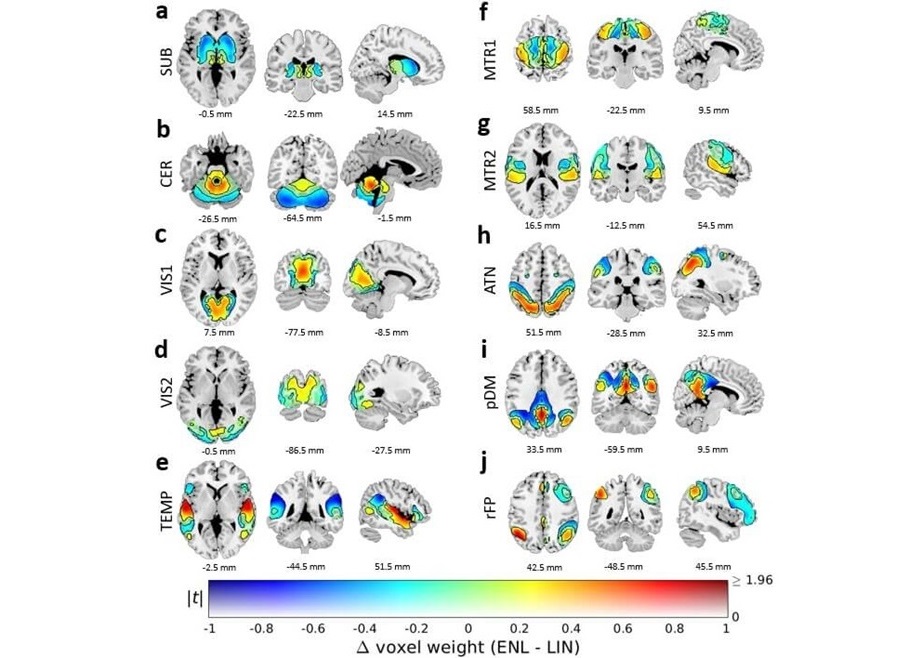

- AI Can Distinguish Brain Tumors from Healthy Tissue

- MRI-Guided Radiation Therapy Reduces Long-Term Side Effects in Prostate Cancer Patients

- Combining Imaging Techniques Could Enable Surgical Removal of Prostate Cancer Without Biopsy

- AI Supported Detection of Cerebral Multiple Sclerosis Lesions Cuts Radiologic Reporting Times

- AI Algorithm Detects 30% Of Breast Cancers Missed on MRI Scans

- New Imaging Agent to Drive Step-Change for Brain Cancer Imaging

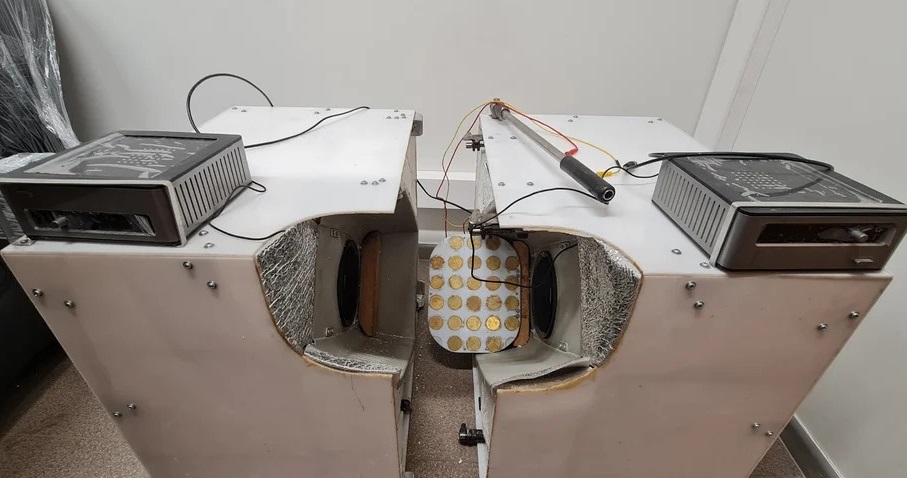

- Portable PET Scanner to Detect Earliest Stages of Alzheimer’s Disease

- New Immuno-PET Imaging Technique Identifies Glioblastoma Patients Who Would Benefit from Immunotherapy

- PET Software Enhances Diagnosis and Monitoring of Alzheimer's Disease

- New Photon-Counting CT Technique Diagnoses Osteoarthritis Before Symptoms Develop

- AI Image-Recognition Program Reads Echocardiograms Faster, Cuts Results Wait Time

- Ultrasound Device Non-Invasively Improves Blood Circulation in Lower Limbs

- Wearable Ultrasound Device Provides Long-Term, Wireless Muscle Monitoring

- Ultrasound Can Identify Sources of Brain-Related Issues and Disorders Before Treatment

- New Guideline on Handling Endobronchial Ultrasound Transbronchial Needle Samples

- Automated Multi-Patient CT Injection System Reduces Patient Set-Up Time and Streamlines Workflows

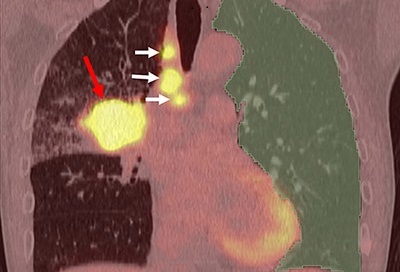

- Low-Dose CT Screening for Lung Cancer Can Benefit Heavy Smokers

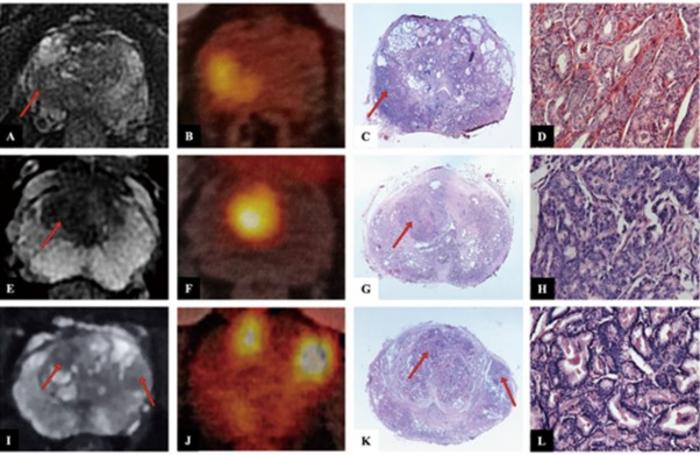

- Non-Invasive Imaging Technique Accurately Detects Aggressive Kidney Cancer

- AI Algorithm Reduces Unnecessary Radiation Exposure in Traumatic Neuroradiological CT Scans

- New Solution Enhances AI-Based Quality Control and Diagnosis in Medical Imaging

- Global AI in Medical Diagnostics Market to Be Driven by Demand for Image Recognition in Radiology

- AI-Based Mammography Triage Software Helps Dramatically Improve Interpretation Process

- Artificial Intelligence (AI) Program Accurately Predicts Lung Cancer Risk from CT Images

- Image Management Platform Streamlines Treatment Plans

- AI Technology for Detecting Breast Cancer Receives CE Mark Approval

- Mindray Partners with TeleRay to Streamline Ultrasound Delivery

- Philips and Medtronic Partner on Stroke Care

- Siemens and Medtronic Enter into Global Partnership for Advancing Spine Care Imaging Technologies

- RSNA 2024 Technical Exhibits to Showcase Latest Advances in Radiology

- Bracco Collaborates with Arrayus on Microbubble-Assisted Focused Ultrasound Therapy for Pancreatic Cancer

(1).jpg)

![Image: A kidney showing positive [89Zr]Zr-girentuximab PET and histologically confirmed clear-cell renal cell carcinoma (Photo courtesy of Dr. Brian Shuch/UCLA Health) Image: A kidney showing positive [89Zr]Zr-girentuximab PET and histologically confirmed clear-cell renal cell carcinoma (Photo courtesy of Dr. Brian Shuch/UCLA Health)](https://globetechcdn.com/medicalimaging/images/stories/articles/article_images/2024-10-04/ca9scan.jpg)